BitMine $BMNR: From Bitcoin Miner to $1B ETH Treasury Mirage - A closer look at the $250m PIPE

A hyped Ethereum pivot, a celebrity Wall Street chairman and the same dilution machine humming away

Key Findings

BitMine used an Ethereum (ETH) narrative to justify a $250M private placement, selling 55M shares at $4.50 to crypto insiders — Ironically, they do not own a single ETH token, nor have they completed any part of their pro forma plan.

Those shares include full resale rights, meaning insiders (including Tom Lee and Kraken Ventures) are contractually cleared to dump shares onto retail investors once BitMine files an S-1/S-3.

BMNR has a float of just 3.2M shares, while 62.3M are outstanding, which creates an artificial scarcity (just 5% of total share in circulation) that fueled a 2,500%+ price spike to $160 per share, before a single ETH token was purchased.

[No 8-K or ETH wallet confirmation as of July 3, 2025] These facts alone are the epitome of a giant red flag.CEO Jonathan Bates structured “insider-friendly” financing through IDI LP, securing preferred equity with anti-dilution and voting protections that disadvantage public shareholders.

This is not treasury management — it is likely an engineered exit. The ETH was never the product, the stock exit itself, is the plan.

BitMine bought a ticket to Wall Street’s junior board with an $18M ThinkEquity deal, the same broker whose micro-cap IPOs (EZGO, AERC, MTC, SGLY) are now down 90 %-plus. The exchange upgrade is cosmetic, yet the dilution is permanent. ThinkEquity is a low tier investment bank.

BitMine’s meaningful mining rigs are owned by the CEO’s private LLC and skims 88% of the bitcoin they produce. While shareholders pay him interest. On top of that, the CEO loans the company money at 12% secured interest, ensuring insider profits no matter how the business performs.

There are no real headquarters, just mailboxes. Old address: Wyoming’s $49 “shell-company row.” (see image below) New address: an Atlanta hot desk space shared with a vape penny stock, a fish-farm SPAC, and a dead nutraceutical shell. Zero sign of industrial infrastructure.

Executive Summary: A $250 Million Exit Disguised as a Crypto Strategy

BitMine Immersion Technologies (BMNR) claims it is transforming into a large-scale Ethereum treasury vehicle. On June 30, 2025, the company announced a $250 million private placement at $4.50 per share, supposedly to fund ETH purchases and make BitMine one of the largest publicly traded Ethereum holders.

The market responded with euphoria. BMNR stock soared over 2,500%, briefly crossing a $1 billion market cap — before a single ETH token was ever purchased.

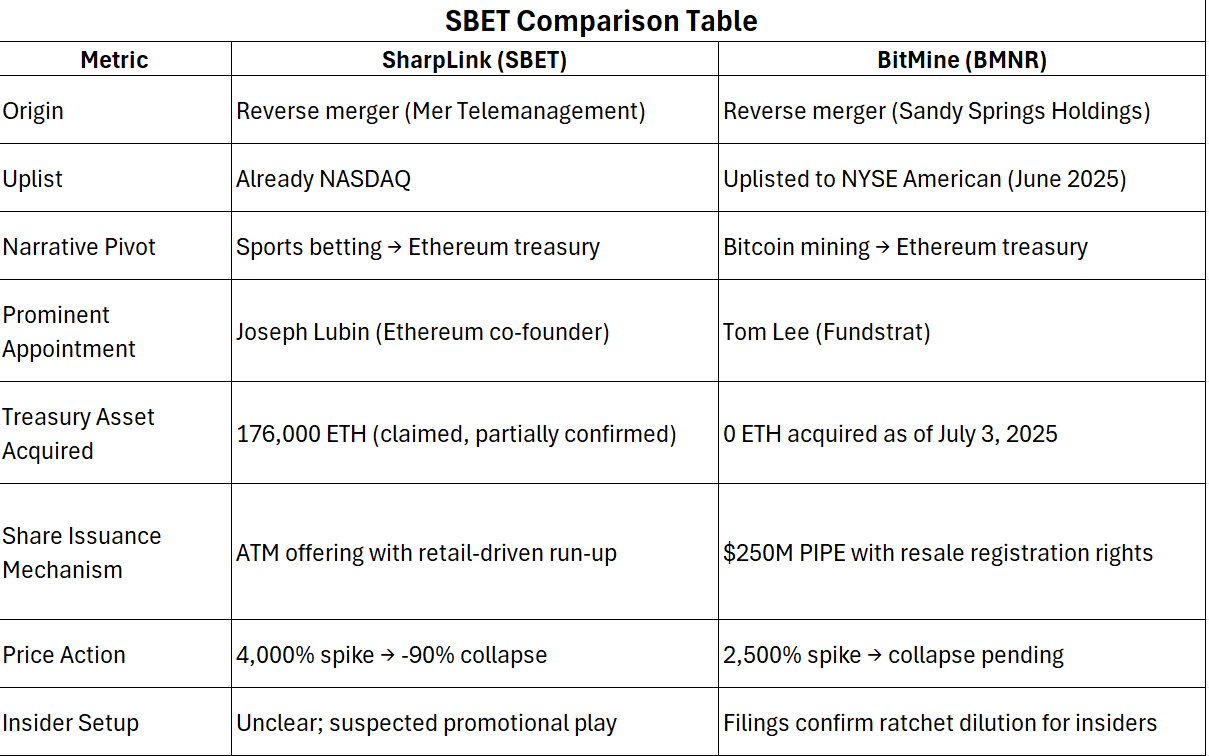

This follows a nearly identical playbook used by SharpLink (SBET): A small float, Ethereum pivot, media hype, and insider resale approval. This drove the stock more than 4,000% higher, only to collapse over 90% after insiders sold, subsequently diluting the stock ten fold in just a matter of days. SBET’s float expanded from just a few million shares to over 70 million. BitMine now shows a nearly identical setup: a float of just 3.2M shares vs. 62.28M outstanding, giving insiders maximum leverage on engineered scarcity. We believe BMNR is likely an engineered exit, where insiders have full incentive to dump into hype once resale registration is approved.

Key Findings

1. BitMine sold 55 million shares to insiders at $4.50, with full resale rights, despite not holding any Ethereum.

The company explicitly disclosed it will register these shares for resale, giving PIPE participants a clear path to legally unload into a retail-driven price spike.

Source – June 30, 2025 Press Release

2. The ETH has not been acquired.

As of July 3, 2025, no 8-K, press release, or public statement confirms BitMine has executed any ETH purchase using the PIPE proceeds. The entire market cap expansion is based on an unexecuted intention.

3. CEO Jonathan Bates structured insider financings through his own fund, IDI LP — securing preferred equity with full-ratchet anti-dilution rights.

Over multiple years, Bates converted insider loans into Series A and Series B preferred stock, including clauses that triggered a reset of conversion prices from $0.575 to $0.20, diluting common shareholders while protecting insider control.

Source – SEC 10-Q, Nov 2024

4. The company has no revenue model tied to Ethereum. Additionally, there is no operating business, which supports the valuation.

BitMine previously operated a Bitcoin mining site, purchased 154 BTC, and offered no ETH-related service or infrastructure. The $250M ETH plan was announced after the fresh uplist from the OTC markets on June 5, 2025. But no mechanism for custody, risk management, or on-chain proof has been presented.

5. The setup mirrors SharpLink (SBET), a company that ran 4,000% on an ETH narrative and collapsed 90% within weeks.

Both companies began as reverse merger shells. SBET added Joseph Lubin (Ethereum co-founder); BMNR added Tom Lee (Fundstrat co-founder and CNBC commentator with no fiduciary crypto experience).

Both announced a pivot to an Ethereum treasury strategy. Both SBET and BMNR executed large equity financings with resale rights. SBET has since imploded.

Tom Lee’s role appears purely promotional — his appointment came just before the $250M PIPE and helped validate the Ethereum narrative without adding governance, execution, or on-chain expertise.

Deep Dive: Anatomy of a $250 Million Exit: How Insiders May Cash Out Before Ethereum Is Ever Bought

What does it mean?

BitMine announced a PIPE deal worth $250 million, selling 55 million shares at $4.50 each. This valuation was justified by a future-looking plan to purchase Ethereum and manage it as a “treasury reserve asset.” However, this was a pretext to facilitate the issuance of a massive amount of stock to insiders and institutional investors under preferential terms.

The key issue is resale registration: BitMine must file an S-1 or S-3 registration statement to make these shares tradable. Once declared effective, this gives insiders legal ability to sell into the public market — likely at inflated prices fueled by retail speculation.

For context, the current float is only 3.2 million shares. Registering and dumping the 55 million PIPE shares would represent a 17x increase in float — a deluge that could trigger a waterfall of downward, selling pressure as supply overwhelms demand.

Who are the people involved?

Jonathan Bates (CEO)

Jonathan Bates is the current CEO of BitMine Immersion Technologies and managing partner at IDI Group. He has structured all of BitMine’s preferred equity rounds through IDI LP, a private vehicle that retains anti-dilution and special voting rights, giving insiders significant protection and control at the expense of common shareholders.

While there is no public record of legal or regulatory actions against Bates, his financing structures—particularly through IDI LP—resemble patterns commonly seen in high-dilution OTC setups, where insiders retain control while retail investors carry the downside risk.

Bates previously operated BitMine LLC, a privately held company with limited operational disclosures, and was involved in a string of low-liquidity corporate entities. Although no definitive failures or fraud have been documented, there is a lack of transparent operating history or investor returns tied to his past ventures.

Filings tied to these structures can be browsed under BitMine’s SEC profile.

Tom Lee (Newly Appointed Chairman to the Board)

Former JPMorgan strategist and co-founder of Fundstrat Global Advisors. Lee was appointed Chairman of BitMine’s Board of Directors just days before the $250M PIPE announcement. His media presence on CNBC and X (formerly Twitter) gives credibility to the Ethereum pivot, despite no prior experience managing public crypto treasuries. His name likely served as a narrative amplifier, triggering retail FOMO without adding governance oversight.

We found no evidence Lee was aware of past insider deals; however, his option-style package means he benefits even if the plan fails.

Kraken Ventures & Founders Fund

Both firms are listed as PIPE participants in BitMine’s $250 M private placement, giving the appearance of institutional legitimacy. However, their track records suggest opportunistic involvement rather than long-term governance support.

Kraken Ventures has previously backed crypto startups associated with speculative, “Pump and Dump” behavior. A notable example is Synapse Protocol, a cross-chain DeFi bridge that suffered a major exploit in November 2021 from its liquidity pools. The exploit triggered a steep drop in the SYN token price and caused retail losses — with no public response from Kraken Ventures as a backer.The incident caused sharp losses for retail holders and raised questions about security oversight — yet Kraken made no public response.

Founders Fund was an early investor in Block.one, the company behind the $4B EOS Initial Coin Offering (ICO), which later faced a $24M SEC penalty for unregistered securities issuance. EOS failed to deliver its decentralized infrastructure as promised, and insiders were accused of dumping tokens to the detriment of retail investors.

Past Behavior Patterns

Jonathan Bates – IDI Capital

Previously involved in failed renewable energy shells (e.g., Greenwave Energy, delisted).

Known to recycle SPACs and OTC shells under trending narratives.

History of insider loans converted to equity at steep discounts.

Tom Lee

Public crypto bull since 2017. Mr. Lee frequently makes predictions tied to ETH/BTC price spikes.

Has never managed ETH on-chain in a professional or fiduciary capacity.

No public track record in treasury management.

Why This Structure Raises Alarms

BitMine’s setup resembles a manufactured squeeze structure: insiders control a tiny float (3.2M shares vs. 62.28M outstanding), while using bullish Ethereum press releases and Tom Lee’s name to drive retail demand. This combination creates artificial scarcity, attracting short-sellers. But since insiders aren’t selling yet — and the PIPE shares aren’t registered — there’s no true supply to balance the hype. This engineered scarcity fuels vertical price spikes, setting the stage for a high-volume dump once resale registration is approved.

The private placement was announced before the uplisting was complete.

The ETH hasn't even been purchased, yet the company traded as if it had.

The PIPE shares were priced at $4.50, while the stock surged to $120+, creating a 2,500% markup for insiders.

There is no ETH wallet, no custodian, and no mechanism for investor auditability.

BMNR is using press releases, not on-chain data or SEC filings, to justify a $1B market cap.

This shows all of the signs of financial engineering, a set-up… perhaps even a scheme that is built for structured, exit liquidity.

To understand the risks facing BitMine, look no further than SharpLink Gaming (NASDAQ: SBET) — a recent example of an Ethereum-based pivot that ended in disaster. SBET used the Ethereum narrative to justify a share run-up, only to collapse over 90% after insiders sold. The parallels to BitMine are striking.

The situation unfolding at BitMine closely mirrors the recent collapse of SharpLink Gaming (NASDAQ: SBET) — another microcap company that attempted an Ethereum-based pivot to justify a $400M valuation spike before collapsing under dilution and insider dumping.

In SBET’s case, the company:

Claimed to hold Ethereum as a strategic reserve without audited backing.

Was linked to Ethereum Foundation co-founder Steven Nerayoff, who was later arrested on fraud charges.

Issued shares to insiders and PIPE investors via a questionable Ethereum treasury narrative.

Pumped on thin float, then crashed violently as registration filings allowed insiders to legally dump into retail buying.

We covered the full breakdown in our prior Fugazi Research SBET Report — a critical reference point for understanding BitMine’s potential playbook.

Just like SBET, BitMine is selling a narrative before the treasury exists, relies on Ethereum hype, and sets the stage for a registration-triggered dump. The timeline, playbook, and structure are eerily similar, including:

Undisclosed ETH purchases

Media-boosted attention

Pre-registered PIPE deals

10x+ float expansion risk

At this time, we have not found any ties between BitMine and SBET personnel. However, the strategic executions — from treasury language to PIPE structuring — are nearly identical. This pattern is another giant, red flag for investors.

Although BitMine highlights a “NYSE uplist,” this is misleading. BitMine was approved for NYSE American (formerly AMEX), a junior exchange with much lower listing standards, often compared to OTC in terms of risk profile.

Minimum stock price for AMEX uplisting is as low as $0.30. Among many, low standard examples, one example is AEON, which is now trading at $0.79. AEON once traded for hundreds of dollars, but due to splits now trades for under $1.00.

Historical track record includes a high concentration of pump-and-dump stocks, toxic PIPE financings, and companies with questionable fundamentals.

In contrast, NASDAQ’s minimum bid requirement is $4.00 for IPO and $1.00 for continued listing, which acts as a barrier for the preceding plays.

In other words, BitMine did not graduate to the major leagues. It took the backdoor route, just good enough to fool retail, and just risky enough for insiders to execute their exit.

Our View

The core issue is not whether Ethereum is a valuable asset. The issue here is that BitMine does not hold Ethereum, and yet the security is already trading as if it does — while insiders are preparing to sell. This is all based on speculative hype.

We believe the $250 million private placement is not a funding round, but a structured exit vehicle, with resale rights clearly disclosed. The Ethereum story is the catalyst, but the mechanics are standard: cheap shares sold to insiders, followed by a public narrative to drive price, while luring in short sellers to lift the stock higher, which is then followed by a registration process that unlocks a massive supply of stock.

Nothing illegal has been disclosed, however the structure is built for insider enrichment, not long-term value creation.

Until the company confirms ETH has been purchased, disclosed wallet-level proof of custody, and files the resale registration, we view BMNR as a dangerous structure with no true support for when insiders exit.

The Real Product Was the Stock

BitMine's stock surged on the promise of becoming an Ethereum proxy. But in reality:

The ETH has not even been purchased.

The PIPE funding has not closed.

The resale registration hasn’t been filed — yet.

Everything points to this: the Ethereum narrative was the bait, while the stock was the product, and the retail investors have been the unwitting buyers of what will become a valueless, diluted stock.

An NYSE American (AMEX) “Uplist” Built on Endless Dilution Can’t Hide BitMine’s Rotten Core

At first glance, BitMine appears to have turned a new leaf, miraculously healing its self-made regulatory ailments. The company recently paid MaloneBailey to re-audit its financials, which fueled an $18 million raise led by ThinkEquity, the go-to underwriter for sub-$50 million, one-day-wonder IPOs like MTC (Mmtec), Singularity Future Tech (SGLY), EZGO (EZGO Technologies Ltd) and AERC (AeroClean Technologies) to name a few that later cratered.

A deeper look under the hood of this glossy, new facade reveals that the company simply used new investor money to paper over a terminal diagnosis. The core rot remains, and in many ways, the risks for shareholders have only intensified.

A Business Plan to Speculate, Not Operate: The company's S-1 registration statement reveals the operational reality behind the hype: BMNR has less than 1 Megawatt (MW) of hashing power. This is barely a “hobby-miner” scale (“currently operates less than one megawatt”). While touting grand plans for "8 MW" sites and an unfunded, unenforceable MoU (Memorandum of Understanding) for a site in Paraguay. More damningly, the company admits its business plan is to dump the entire $18 million capital raise directly into buying raw bitcoin, rather than investing in its own supposed operations. Investors aren't funding a growing Bitcoin miner; they're funding management's speculative bet on the price of crypto.

A Familiar CEO, Now Armed with Absolute Control: For investors wondering if this is just mismanagement, we again point to CEO Jonathan Bates. This story is now worse than a simple replay of his last failed venture, Clear Skies Solar. This time, Bates and his insiders have learned. The new BMNR has been structured to give insiders iron-clad control through 10-vote-per-share preferred stock. This ensures that while common shareholders provide the cash, insiders have the votes to approve any future dilutive financing or self-serving transaction they wish.

The Insider Siphon Remains On: On top of the super-voting shares, the company’s filings reveal a 12% credit line extended to the company by an insider-related entity, alongside a legacy of Reg D warrants from prior financings. The business model is clear: while the company speculates with shareholder cash, insiders can continue to siphon value out through high-interest loans and future dilution.

Don’t be fooled by the “uplist” BitMine didn’t graduate to the NYSE or Nasdaq. Rather, BMNR slid onto the NYSE American, a “junior exchange” that sits a full tier below Nasdaq/NYSE. What shareholders really bought into is a micro float, $250 million, of which management plans to punt into the ether, and a voting structure so rigged that only the insiders win when the stock eventually falls.

A CEO's Playbook, Perfected: From SEC Revocation to an Insider-Proof Fortress

To understand where BitMine (BMNR) is headed, investors need only look at the history of its CEO, Jonathan Bates. This isn't his first time running a speculative public shell company, but it appears he has learned from his past. His previous venture ended in a simple regulatory execution. However, this time, he has a more sophisticated structure designed for insider enrichment, cloaked in a new facade of legitimacy.

Act I: The Original Playbook - The Collapse of Clear Skies Solar

Jonathan Bates’ history as CEO of Clear Skies Solar, Inc. (CSKH) provides the blueprint for his strategy. The playbook was simple and effective:

The Shell & The Story: CSKH was a speculative micro-cap shell, rebranded to capitalize on the "green energy" bubble of its day.

The Hype: The company issued promotional press releases to generate trading volume.

The Silence: After the promotion, the company went dark, ceasing all required financial reporting with the SEC.

The Consequence: On September 25, 2017, after nearly two years of delinquency, the SEC initiated proceedings and permanently revoked the registration of Clear Skies Solar's stock, rendering it worthless and untradeable. The playbook ended in a total loss for shareholders.

Act II: The Sequel - BMNR Replays the Script... At First

BMNR followed the same script almost verbatim. It began as a shell (Sandy Springs Holdings), rebranded to chase the crypto bubble, and then, after its auditor BF Borgers was banned by the SEC for "massive fraud," it descended into the familiar silence of filing delinquency.

For over a year, BMNR was on the exact same trajectory as Clear Skies Solar, heading directly towards an inevitable SEC registration revocation.

Act III: The Twist - Why Settle for Revocation When You Can Reload?

This is where the playbook was upgraded. Instead of letting BMNR stock valuation die, Bates and the insiders found a way to not only survive but to entrench their control permanently. They secured an $18 million capital raise from ThinkEquity. This cash infusion was used to purchase a facade of legitimacy: they hired a new auditor, re-filed their delinquent financials, and successfully uplisted to the NYSE-American exchange.

But a look at the fine print of this "turnaround" reveals the true endgame. The cost of this legitimacy for new investors was handing absolute power to the very CEO with a history of wiping out shareholders.

Iron-Clad Insider Control: The new BMNR has been structured to give CEO Jonathan Bates and other insiders 10-vote-per-share preferred stock. This makes their voting power absolute and renders common shareholders powerless to challenge any future decisions.

CEO-Controlled Credit Line: BitMine can draw up to $1.75 million from Immersion Development Inc. A company 100 % owned by CEO Jonathan Bates. Guaranteed 12 % Yield + 3 % Origination Fee: Every dollar BitMine borrows funnels a double-digit, secured return straight into the CEO’s private pocket. Paid with cash raised from public investors. Common shareholders absorb dilution and operational risk, while the CEO enjoys a risk-free 12 % coupon regardless of BitMine’s performance.

A "Business Plan" to Speculate, Not Build: The company's own filings admit the plan is to use the new $18 million not on operations, but on buying raw bitcoin—turning the public company into a speculative crypto holding fund managed by a CEO whose last venture was revoked.

CEO’s Miner Flip: 88 % of BitMine’s Bitcoin Hijacked by His Own LLC

BitMine secretly sold its meaningful mining fleet, 150 Antminer S19s, to the CEO’s private LLC for $675,000, then immediately leased them back on a deal that diverts 88 % of every future bitcoin to the CEO-owned Immersion Associates LLC while BitMine keeps a token 12 % “hosting fee.”

• The one-day flip let management book a $231,000 paper gain and a cosmetic bump in FY-2024 revenue. However, it stripped $0.7M of hard assets off the balance-sheet and left shareholders paying the power bill for rigs they no longer own.

• If the transaction had not occurred, BitMine would have reported virtually the same top-line (~$3.3 m) BMNR and its shareholders would have received 100 % of the bitcoin those machines generated. However now the CEO gets the miners and 88% of the Bitcoin that is mined.

Translation: BitMine traded long-term economics for a short-term accounting pop, funnelling the core cash-flow engine to the CEO’s private LLC and leaving investors with nothing but a 12% hosting scrap. In our view this is not capital allocation; it’s value extraction in plain sight.

This deal only surfaced when the S-1 was filed for the NYSE uplist. In other words, the CEO’s side-deal/equipment flip sat undisclosed for roughly eight to ten months, surfacing only when BitMine was forced to open its books.

From a $49 Wyoming Mailbox to an Atlanta Hot-Desk: BitMine Still Has No Real Headquarters

BitMine’s last "Headquarters” address was at 30 N. Gould St., Sheridan, Wyoming, one of the cheapest mail-drops in America.

The storefront sells $49–$99 “virtual office” packages (mail scan, forwarding, nominee service) and houses 20-50,000 anonymous LLCs. Local press and Reddit have dubbed it “shell-company row”.

BitMine currently lists 2030 Powers Ferry Rd. SE, Suite 212, Atlanta, as its “Headquarters”. A quick EDGAR pull shows the identical Suite 212 mailbox is already home to:

BELL – Bellatora, Inc. (OTC vape / CBD promo stock)

NCRA – Nocera, Inc. (Nasdaq fish-farm SPAC out of Taiwan)

TMXN – Trimax Corp. (Pink-sheet “nutraceutical” shell)

This address is nothing more than a shared-office hub with mail drops, phone forwarding, and a handful of flex desks. BitMine has not upgraded from its Wyoming shell mailbox to a legitimate corporate headquarters. Instead, it has simply swapped one rented slot for another, parked beside a CBD penny stock, a defunct nutraceutical shell, and a micro-cap fish-farm SPAC. This is not operational scale! This is a giant concern and red flag for unwitting investors.

Final Word

Ironically, BitMine presents itself as a new kind of Ethereum-native treasury company, yet the story collapses on the first contact with the filings. In reality, BMNR follows a well-worn path used by financial engineers that is built to enrich insiders, consequentially yielding no value.

Here is the simple, yet effective scheme:

Step 1: Acquire a shell.

Step 2: Inject a trendy narrative.

Step 3: Add a recognizable name to the board.

Step 4: Sell discounted shares to insiders.

Step 5: Let retail run the stock.

Step: File resale paperwork.

And finally: Sell shares to exit.

And finally: Sell shares to exit.

In our view, the “Ethereum treasury” is a narrative designed to manufacture exit liquidity, not a business plan. The real product here is the stock itself, carefully manipulated on artificial scarcity and media sizzle, ultimately destined to be sold into the market once registration unlocks the insider supply.

Investors should ask themselves one question: when the PIPE shares are free-trading, who will be buying from Tom Lee, Kraken Ventures, and the CEO’s own entities. And at what price?

Disclaimer & Disclosure

Fugazi Research is an investigative research publication focused on exposing accounting irregularities, mismanagement, and other red flags. Our reports reflect our opinions, which are based on public information and our own analysis. Fugazi Research, its affiliates, or related individuals may have positions—long or short—in securities mentioned and may profit from price movements following publication. This is not investment advice. All investors should do their own research and consult with a licensed financial advisor.

Thank you for digging into this. I hope that public share holders were able to get out when the price pumped. Do you have any insights on $BTBT's recent transition to holding Eth instead of BTC? They have made public that they have sold all of its BTC for Eth. Thanks!